What Is a Jumbo CD? Regular CD ? Here is what you you should know in 2024

Defining What is a Jumbo CD?

What is a Jumbo CD : Comparable to regular CDs but have a larger minimum balance requirement.

Table of Contents

Key Note

* A certificate of deposit (sometimes known as a CD) is a type of savings account where you can deposit money and collect interest on it once the term is up.

- A certificate of deposit with a larger minimum balance requirement is called a jumbo CD.

- You should often receive a better interest rate on your investment because you are making larger deposits.

- One of the safest investment alternatives is a certificate of deposit (CD), which is insured up to $250,000 if you purchase one from a bank.

- There are fees associated with early withdrawals from CDs, and they are not a liquid asset.

An explanation of what is a jumbo CD and an example

You can deposit money into a CD for a predetermined amount of time. You’ll get interest on your investment if you leave your money in the CD for the whole duration.

Higher minimum balance requirements apply to jumbo CDs. As a result of your larger deposit, you will frequently receive a higher interest rate. However, where you open the CD, how long your term is, and how much you deposit will all affect how much interest you really earn.

Important Note

It is beneficial to compare prices before selecting a big CD. An online bank may provide a larger CD than your present bank does, one that better suits your objectives and financial situation.

For instance, the Latino Credit Union offers a 60-month jumbo CD with a minimum investment of $100,000 that pays 2.35% interest. By contrast, the same credit union offers a six-month jumbo CD with an interest rate of 0.35% on the same initial deposit.

How a Jumbo CD Works?

Like a standard CD, a jumbo CD operates by having you deposit a set amount of money and commit to a predetermined term. There is a six-month to five-year term variation. At the conclusion of your term, interest will be paid to you on the deposited monies.

The difference is that a jumbo CD comes with higher minimum balance requirements. You can typically open a jumbo CD at a bank or credit union.

Always read the terms and conditions your bank sends you when opening a jumbo CD before funding the account. Make sure you are aware of the interest rate and any early withdrawal penalties.

If you want to receive interest on your investment and have a sizable amount of savings, a jumbo CD is a suitable choice. In February 2022, for instance, the National Deposit Rate on a savings account was 0.06%, while the interest on a 12-month CD was 14%.

Advantages and Disadvantages of a Jumbo CD

- Pros

Earn interest

Safe investment

No broker commission fees

- Cons

Not a liquid asset

Riskier than regular CDs

Early withdrawal penaltiession fees

Advantages Explained

Earn interest: Since CDs provide a fixed rate of return, you know how much you’ll earn on your investment.

Safe investment: If you buy a CD through a bank, your investment is insured for up to $250,000. That makes CDs one of the safest investment options available.

No broker commission fees: Since you invest your money directly with the bank or financial institution, you don’t have to pay any broker commission fees.

Disadvantages Explained

Not a liquid asset: Since you agree to leave the funds in a CD for a specific period, you can’t convert them to cash without penalties or in a hurry if you need to.

Riskier than regular CDs: The FDIC only insures up to $250,000 for a single account, so if a jumbo CD exceeds that limit, part of your investment is at risk.

Early withdrawal penalties: You’ll incur penalties and fees if you withdraw the funds from a CD before its maturity dates.

What is a Jumbo CD Rate

The interest rate that banks and credit unions give on jumbo CDs is known as the “jumbo CD rate.” Because jumbo CDs demand greater deposits than standard CDs, jumbo CD rates are often higher than regular CD rates. Jumbo CD interest can be compounded either daily or monthly. Over the course of your CD, you will make more money the more often interest compounds.

Jumbo CD rates can differ significantly according on the financial institution as well as elements like the term duration and deposit amount. Before choosing a term, check rates offered by various banks and credit unions to see which offers the best jumbo CD rates. A great place to start your comparison shopping is with our list of the top jumbo CD rates.

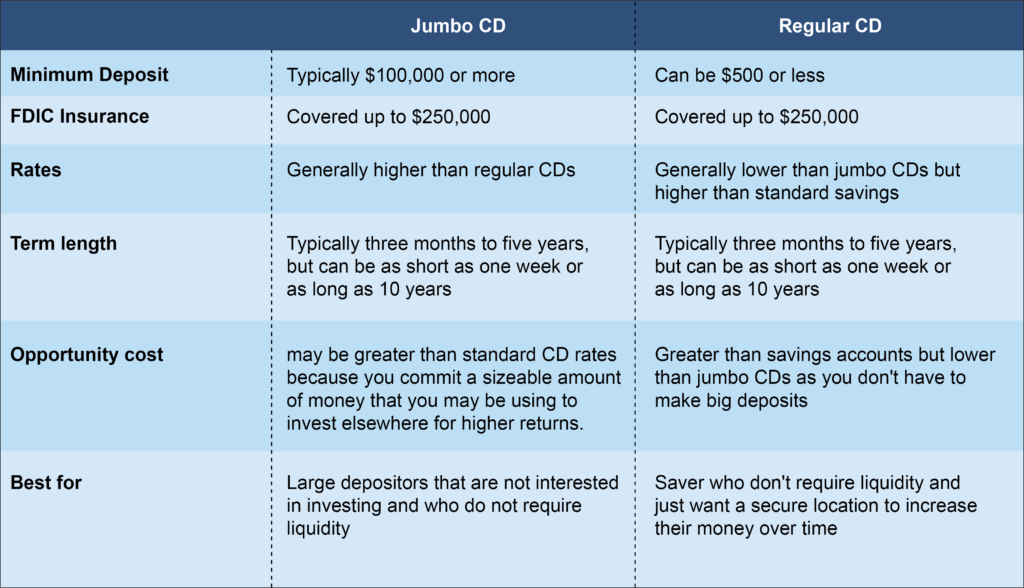

Jumbo CD vs. Regular CD

Editorial disclaimer:

Opinions expressed here are the author’s alone, not those of any bank, credit card issuer, airline or hotel chain, and have not been reviewed, approved or otherwise endorsed by any of these entities.

Nice and informative Blog

Thanks